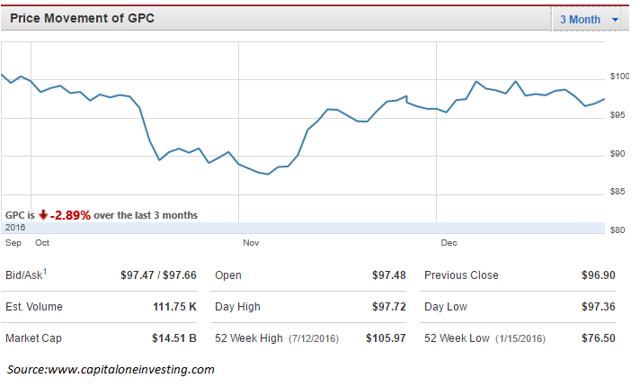

Genuine Parts Company (NYSE:GPC[1]) is engaged in the distribution of automotive replacement parts, industrial replacement parts, office products and electrical/electronic materials through its four operating segments. It has paid rising dividends for 60 years. Its run-up in price since early November has pushed it above my buy target price.

Is GPC a good investment partner?

When I first heard of GPC, I thought it was an auto parts company. But as I researched it, I found that it does a lot more and is actually a diversified company that operates in several different markets. On the company website, this presentation[2] provides a detailed look at the company and its prospects. Investors should look at the whole presentation, but below I highlight the most important slides.

The slide above shows the sales history for the company for the last 10 years. It also shows relative EPS growth. While growing those over time is very important, the performance during the Great Recession is even more important. While it had two hard years in 2008 and 2009, GPC recovered by 2011.

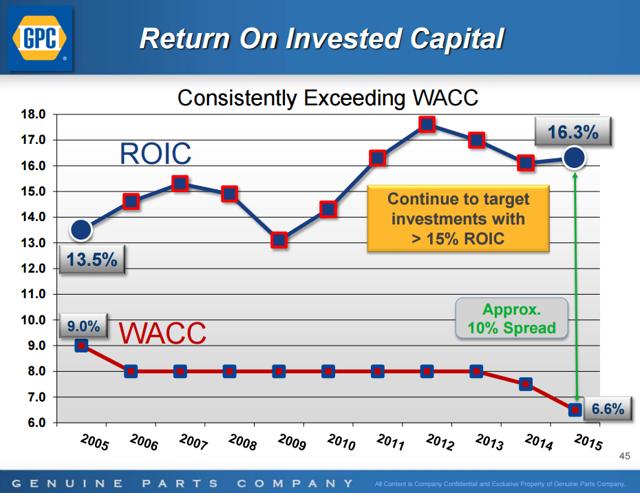

The slide above shows that GPC is effective in deploying the capital it raises in growing the company. This is important in that such success helps keep its credit rating high (and thus borrowing costs low) and because it ensures that covering interest payments will not hurt the profits going forward. It also shows that management isn't just growing the company to make bigger empires, but actually makes it a more valuable company.

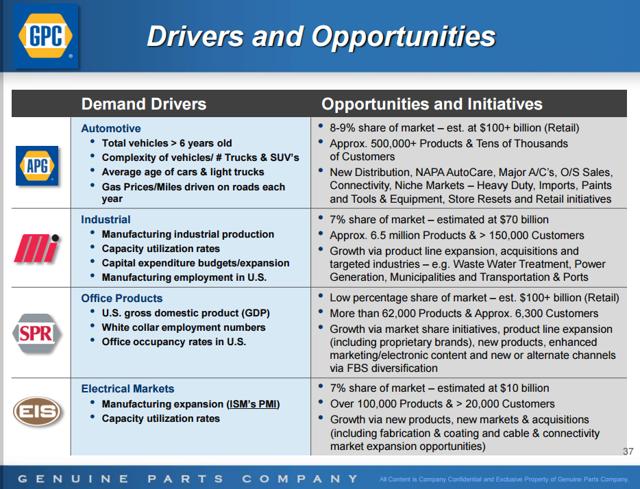

This next slide shows management has a plan for the future. They have identified what will drive demand in each of the operating segments. From that they have identified opportunities for growth in each segment. Growth doesn't just happen, not over the long term anyway, it requires a plan and this looks like GPC management is implementing such a plan.

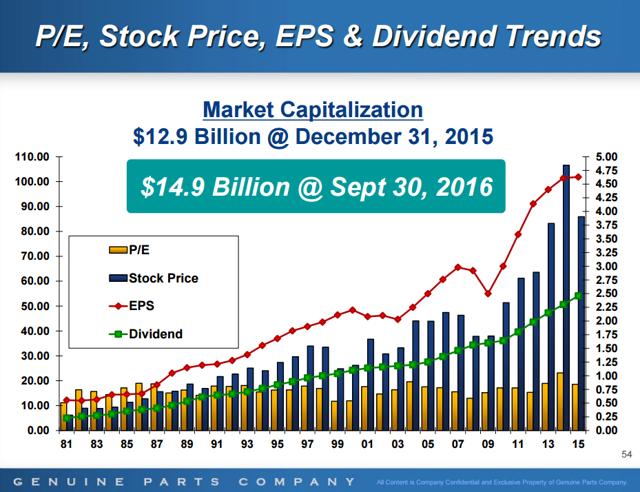

Above is a slide important to every dividend growth investor. Growing dividends is what we aim for, and GPC has been delivering that for 60 consecutive years. The 7% growth from 2015 is also very welcome. I wish my job had given me a raise as high in the last decade.

This last slide shows not only the increasing dividend payment, but also the EPS. Without growing EPS, the dividend will soon stagnate. That hasn't been the case with GPC, as even during the Great Recession years EPS was well above the dividends paid out. One thing very well illustrated by the chart in this slide is the growing spread between EPS and dividend payments. That gives GPC plenty of cushion to continue increasing the dividend should economic difficulties slow the growth of EPS.

What's a good price?

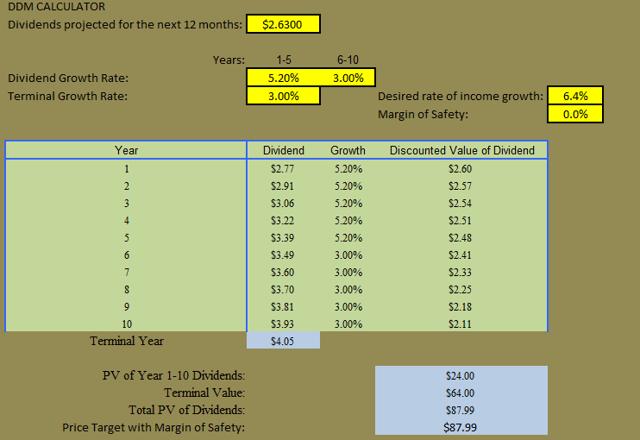

To figure out a good price, I do a DDM calculation using my Excel® based DDM calculator (pictured above, you can see the web-based calculator I based it on here[3] and read a discussion on how the formulas were developed here[4]). Using the lowest DGR from the CCC List[5] of 5.2% (given that is lower than the projected increase in EPS for next year, I think that is a good conservative growth estimate) as the short term dividend growth rate, I calculate a PV for the predicted dividend payments of $87.99. Morningstar give a fair value estimate of $87. The 4 year average dividend yield is 2.7% and using $88 as a target buy price gives a yield of just a couple of basis points below 3%. Based on those figures, I think GPC is a buy at any price of $88 or less.

Can options help?

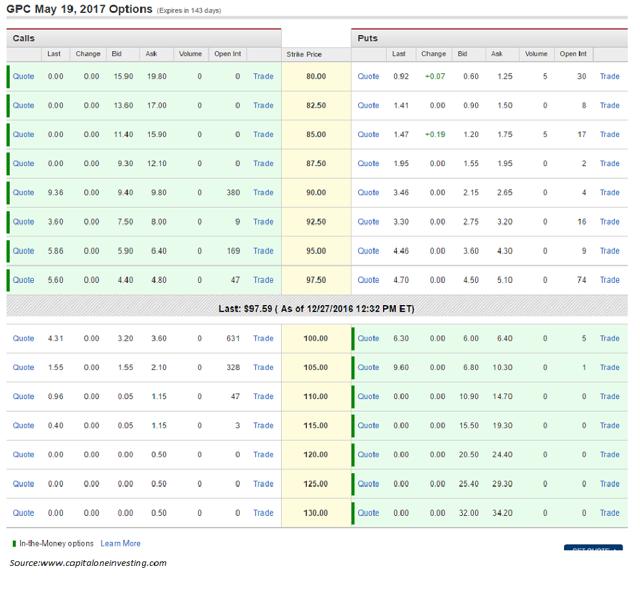

Because of the large amount GPC is below my target price, I had to go out to the May expiration date to find reasonable premiums for the strike prices I wanted. At 143 days till expiration, these contracts might be longer than some investors are comfortable with.

On the put side, the $87.50 strike offers a bid price of $1.55 that is more than half a year's worth of the dividend. With a Delta of -0.20, that gives about a 20% chance of getting the shares assigned if you write this contract. If you like GPC and are okay with a 2.77% yield, this could be a very good contract to write, even with the fairly low odds of getting the stock before the expiration date.

Writing a covered call at this expiration date also offers a good contract. The $105 strike price call has a bid price of $1.55 but the spread is so wide between bid and ask, that an investor should use a limit order perhaps starting with $1.80. That will more than double the cash flow from dividends alone and would give a nice boost to a portfolio over the just under 6 months till contract expiration. With a Delta indicating the chance the shares will be called away is only 20%, it's a reasonable risk to take.

For the more adventurous, or those looking to sell GPC at a reasonable price, the $100 strike call offers twice the premium (but $5 less if the shares are called away). With a Delta of 0.29, that is still less than 1 chance in 3 that the shares will be called away.

Conclusion

GPC is a good solid company with a diversified set of products. It has a long dividend history, with a history of earnings growth to support those dividend payments. It looks well positioned to grow both earnings and dividends into the future. However, it is now trading at a price that is too high. Wait for a pull back in price, or perhaps try your hand at options.

Note: I hope you all got something out of this article. I do appreciate the time you took reading it. If you are one of those who follow me here, I appreciate it; if you'd like to include yourself amongst those individuals, please hit the "Follow" button next to my name as well as following other contributors whose work you enjoy. As always, please leave any feedback and questions you may have in the comments below.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended. The price I call fair valued is not a prediction of future price but only the price at which I consider the stock to be of value for its dividends.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

References

- ^ Genuine Parts Company (seekingalpha.com)

- ^ presentation (genuineparts.investorroom.com)

- ^ here (www.moneychimp.com)

- ^ here (www.moneychimp.com)

- ^ CCC List (www.dripinvesting.org)